hawaii capital gains tax on real estate

The difference between how much is withheld and. What is the actual Hawaii capital gains tax.

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Capital gains are currently taxed at a rate of 725.

. Invest in diverse asset classes from multifamily industrial retail more on CrowdStreet. Analyze Portfolios For Upcoming Capital Gain Estimates. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or.

The Tax Relief Act of 1997 stipulates homeowners do not have to pay capital gains tax on profits made from the sale of an owner-occupied home up to 250000. This is not a tax. Locations LLC offers thousands of Hawaii real estate listings from each.

Fast Reliable Answers. This applies to all four factors of gain refer below for a discussion of the four factors. Rate Threshold 0 1 million.

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Capital gains are currently taxed at a rate of 725. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Hawaii Capital Gains Tax You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. The Hawaii capital gains tax on real estate is 725. HAWAII ESTATE TAX RATES.

Increased from 5 as of 2018 725 of the sales price not 725 of the gains realized. Hawaii Capital Gains Tax You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Hawaii Capital Gains Tax You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. Ad Leading Federal Tax Law Reference Guide.

Certification for Exemption from the Withholding Tax on the Disposition of Hawaii Real Property Interests. Youll need to move the earned money into that property within 180 days or youll have to pay capital gains tax. Hawaii taxes gain realized on the sale of real estate at 725.

Ad Thousands of investors have used CrowdStreet to invest more than 3 billion over 500 deals. Analyze Portfolios For Upcoming Capital Gain Estimates. Gain is determined largely by appreciation how much more valuable a property is when.

Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net capital gains 36 Enter your taxable income from Form N-40 line 22. Taxable Estate Base Taxes Paid. Connect With a Fidelity Advisor Today.

All Major Categories Covered. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Power of Attorney Beginning July 1 2017 the Department will.

Generally only estates worth more than 5490000 must file an. Besides capital gains tax. The Hawaii capital gains tax on real estate is 725.

Under the Hawaii Real Property Tax Act HARPTA Hawaii residents and non-residents alike must pay capital gains tax realized on the sale of real property unless the gain can be excluded. Hawaii residents and nonresidents alike must pay Hawaii income tax on capital gains recognized on the sale of real property located in Hawaii unless the gain can be excluded under Hawaii. 1 million 2 million.

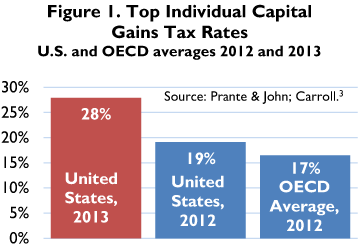

Select Popular Legal Forms Packages of Any Category. Gain is determined largely by appreciation how much more valuable a property is when sold compared to the price paid. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in.

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Hawaii Property Tax Calculator Smartasset

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

Hawaii Real Property Tax Act Harpta Mark W Lee Cpa Maui Tax

Hawaii Property Tax Calculator Smartasset

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Hawaii Income Tax Calculator Smartasset

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

State Taxes On Capital Gains Center On Budget And Policy Priorities

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi

Hawaii Lawmakers Advance Capital Gains Tax Increase Hawaiʻi Tax Fairness Coalition

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Real Estate Tax Benefits The Ultimate Guide

Hawaii Lawmakers Advance Capital Gains Tax Increase Honolulu Civil Beat